The first half of 2025 saw K-pop further cement its position as a global cultural and commercial powerhouse, according to the Luminate Midyear Music Report released Thursday.

The first half of 2025 saw K-pop further cement its position as a global cultural and commercial powerhouse, according to the Luminate Midyear Music Report released Thursday.

While the genre continues to generate strong physical sales and fan engagement worldwide, the latest figures suggest a plateau in digital growth, particularly in key markets such as the United States.

South Korea ranked fourth globally in Luminate’s Export Power Rankings — trailing only the U.S., UK, and Canada — underscoring its ongoing soft power influence across international music markets. K-pop’s strongest import markets remained in Asia, with Taiwan, Japan, and Singapore emerging as the top consumers.

Blackpink’s Rose was named South Korea’s top artist export for the period, largely due to the enduring success of “APT.,” the lead single from her debut solo album “Rosie.” The track’s impressive streaming performance and chart longevity helped distinguish Rose from her peers, signaling a shift toward solo acts driving global reach amid evolving group dynamics.

However, K-pop’s digital reach in global streaming remains limited in scope.

The genre failed to crack the top 10 by overall streaming volume in the U.S. — a market where its audience remains dedicated but relatively niche. BTS had occasionally appeared in previous Luminate reports among top global streaming acts, but their absence this year highlights the intensifying competition from Western pop stars and surging regional genres like Latin and Afrobeats.

Fanbase engagement and tech affinity

Fan communities also demonstrate notable strength on digital platforms. K-pop ranks second on Discord behind J-pop, ties for first place on Reddit with Electronic/Dance, and holds high placements on Twitch and WhatsApp. On these platforms, fans engage in activities such as live discussions, sharing exclusive media, participating in fan-led events, organizing streaming parties, and coordinating tipping campaigns.

CD sales remain a lifeline

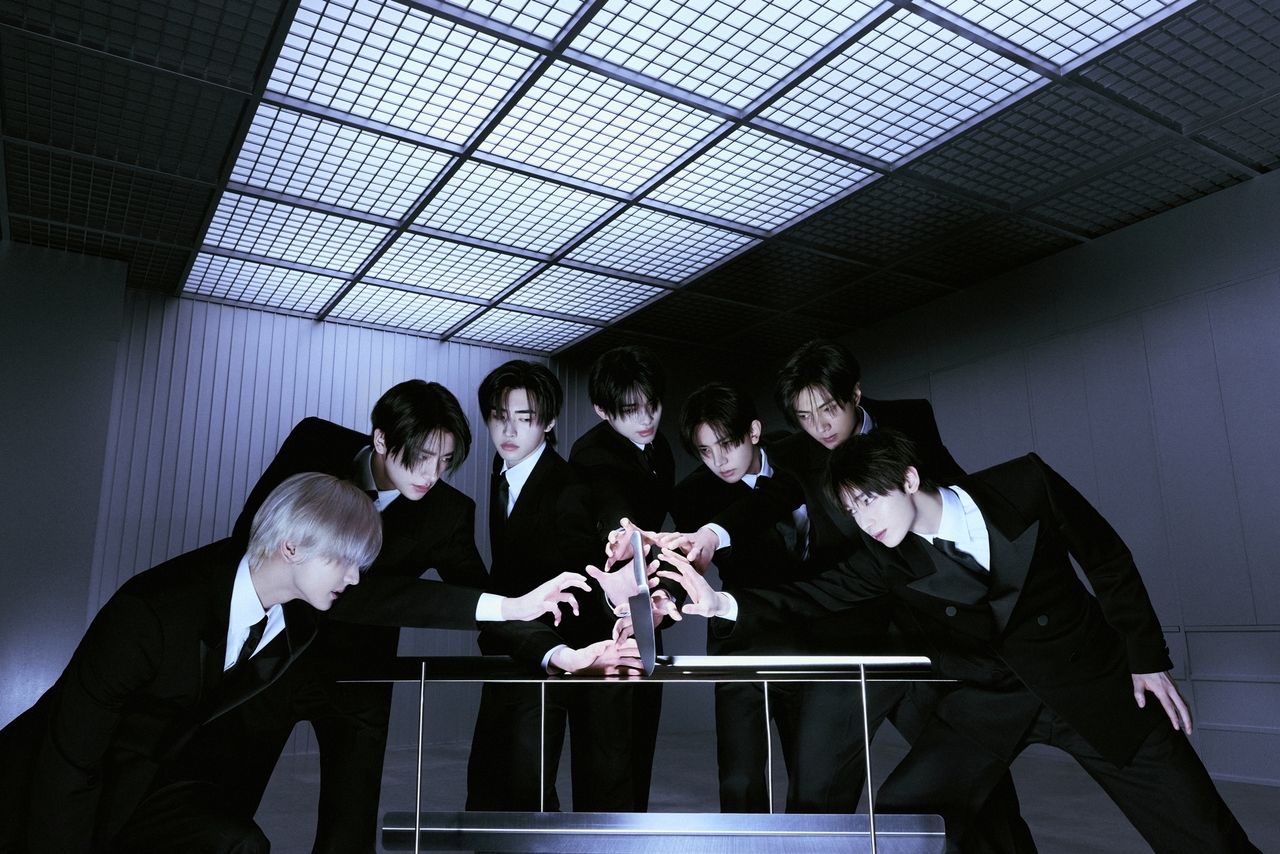

The report also highlights the genre’s continued strength in physical formats. K-pop’s representation in the U.S. Top 10 CD Albums chart was among the strongest across all international genres. Stray Kids ranked second overall with their first mixtape “HOP,” selling 149,000 copies. Enhypen followed closely behind, placing third with 145,000 units of its sixth EP “Desire: Unleash” sold — a figure reached within just one month of its June release. The album also debuted at No. 3 on the Billboard 200 and remained on the chart for five consecutive weeks.

Ateez landed in fourth with its 12th EP “Golden Hour: Part. 3,” which moved 116,000 units. Seventeen’s “Happy Burstday,” released as their fifth full-length album, placed seventh with 79,000 copies sold in the U.S. Despite the group’s overall global sales reaching nearly 3 million copies — the highest among all K-pop releases so far in 2025 — the U.S. CD figure indicates that their core strength still lies in international markets, particularly Asia.

Le Sserafim achieved a rare feat for a girl group, entering the U.S. Top 10 CD Albums list at No. 9 with their fifth EP “Hot,” selling 73,000 physical copies. They are the only female K-pop act to enter the ranking during this period, underscoring both their growing visibility and the relative underrepresentation of K-pop girl groups in the U.S. physical chart. Aespa was recognized in Luminate’s “Emerging Artists” category, signaling increasing awareness in the U.S., though they have yet to achieve the breakout success of earlier-generation acts. This designation reflects strong recent track consumption but falls short of marking the group as a household name in Western markets.

Aespa was recognized in Luminate’s “Emerging Artists” category, signaling increasing awareness in the U.S., though they have yet to achieve the breakout success of earlier-generation acts. This designation reflects strong recent track consumption but falls short of marking the group as a household name in Western markets.

Most Commented